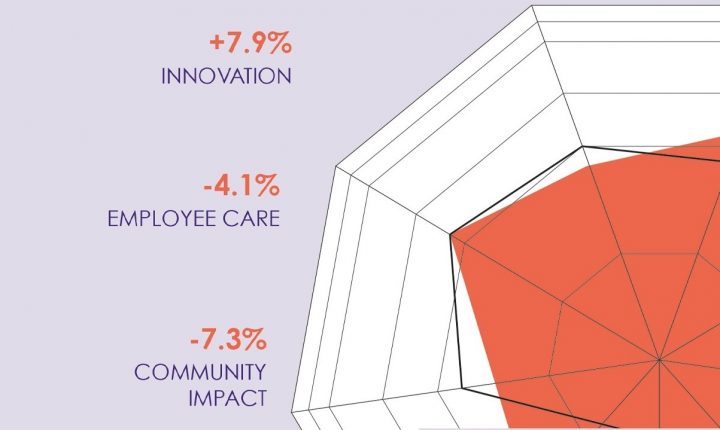

In the study, consumers were asked about their expectations of and experiences with various companies across the Dutch food chain, including animal feed, agricultural wholesalers, meat producers, dairy producers, food manufacturers and beer brewers. When it comes to innovation, Dutch food & beverage companies score very well. There is a wide positive gap of 7.9% (2018: 4.7%); the experiences therefore far exceed consumers’ expectations. This is also the highest (positive) score on innovation among the ten industries surveyed in the study. The agricultural sector also scores positively on innovation at 1.8%, albeit a lot lower.